Is The Carbon Bubble About To Burst?

The past fortnight has seen a major victory for environmental activists in the UK with the announcement that Shell will withdraw from the development of the Cambo oilfield project, which could have wide-reaching ramifications.

While the oil giant and major polluter cited a weak economic case for continuing the development, the consistent public scrutiny and legal pressures led by environmental activists cannot be undervalued – as seen by the fact that the entire Cambo oilfield project is currently on pause.

Corporations such as Shell recognise the impact of reputational damage on their profit margins, and maintaining such pressure on the world’s biggest polluters, such as Shell, gives new hope that new fossil fuel developments can be shut down around the world.

At a time when public awareness of the impact of the Climate Crisis is growing, and renewable energy costs are at an all-time low, it also begs an important question for all of our futures: is the carbon bubble about to burst?

What Is The Carbon Bubble?

Much like any other economic bubble, the carbon bubble reflects that the cost and investments in the fossil fuel industry will rapidly lose their value due to long-term artificial inflation, which will eventually leave stranded assets – which in turn will impact the global economy.

Economic bubbles happen any time the value of something out-strips its actual worth. In this respect, we can compare the artificially inflated value of oil to that of Beanie Babies in the late 90s, when those who gave credence to the over-inflated expense of stuffed toys were blind to the actual cost of manufacture and the ever-diminishing interest in the product.

And even then, this is an unfair comparison for the Beanie Babies, as they did not cause vast ecological destruction and the deaths of millions of people each year.

Bursting The Carbon Bubble: Good or Bad?

There can be little debate that the carbon bubble will burst – it is only a matter of when.

A Nature Energy article published in November 2021 suggests that half of the world’s fossil fuel assets could become entirely worthless as soon as 2036 owing to necessary climate action.

Recent analysis suggests that the carbon bubble could be worth anywhere between $1-4 trillion – while others place the potential cost as high as $11 trillion – which in turn will lead to the loss of jobs and could spell the end of major fossil fuel corporations as their values plummet.

There is also a reasonable expectation that, depending on how quickly the bubble bursts, this could trigger a global financial crisis.

However, it could well be argued that bursting the carbon bubble also represents a major positive for global society and our chances of overcoming the Climate Crisis.

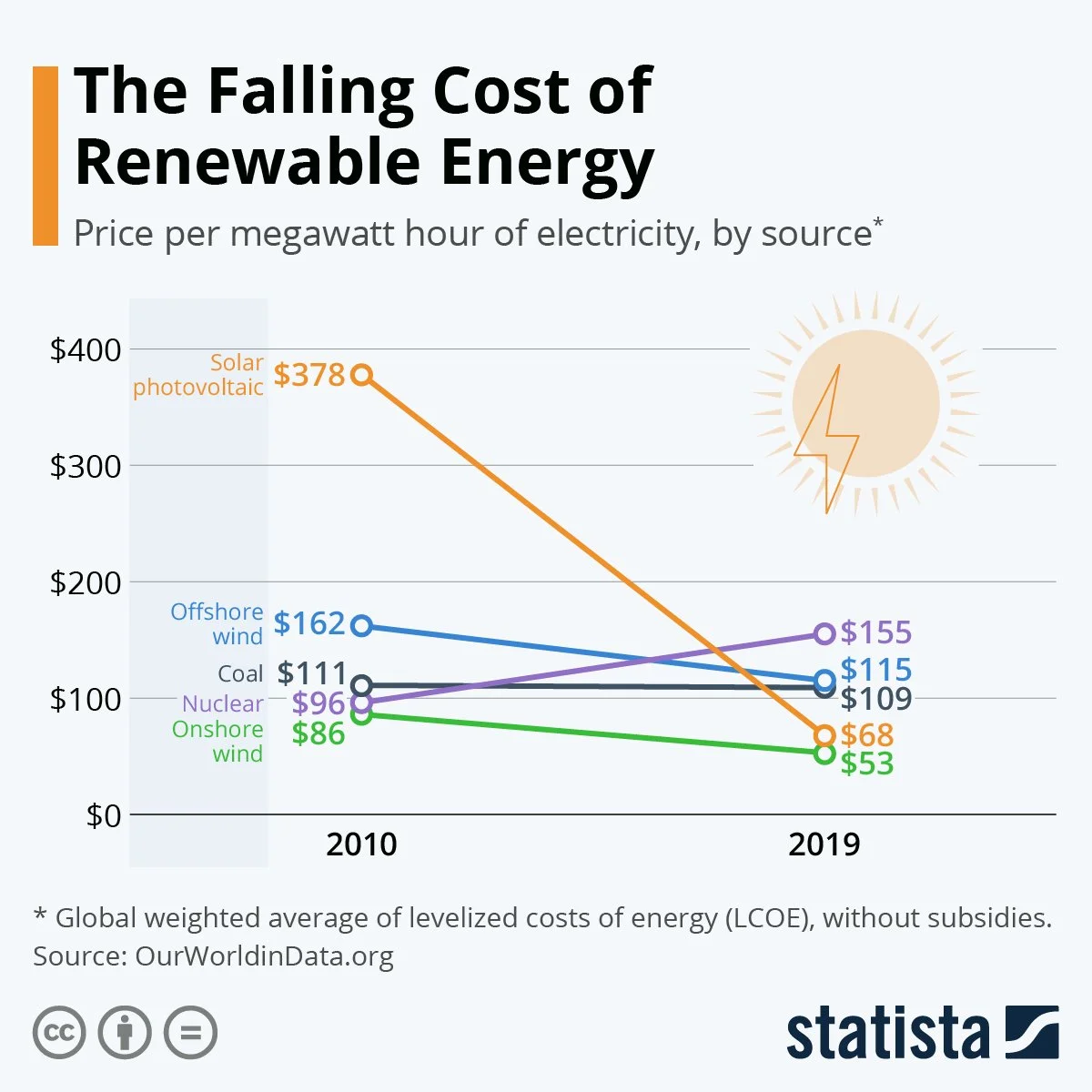

While the cost of fossil fuels has been consistently inflated by government subsidies and global markets, the price of renewable energy generation has fallen dramatically over the pas decade, offering a clean solution without the inherent public health and climate impacts of fossil fuels. Credit: Statista

Ultimately it represents a balance that corrects the unnatural inflation of fossil fuel assets and the capitalist promise of permanent growth and riches.

A key positive of bursting the carbon bubble is that the current price of fossil fuels does not reflect their cost in damaging ecosystems, the climate and public health. Were they priced to include these essential factors – especially with government subsidies removed – they would already cost so much that buyers would already defect to cheaper and cleaner alternatives, such as renewable energy.

As a result, the carbon bubble bursting would lead to more fossil fuels staying in the ground and fewer harmful emissions – as well as less economic power for big oil and coal corporations to exercise in lobbying.

Time To Act

While we might see that there are positives in the carbon bubble bursting for the future of the planet, the ensuing energy insecurity is likely to affect the poorest people in society the greatest as energy prices will skyrocket and those without the means or support to adopt cleaner energy will be left holding the bill.

The inevitability of the carbon bubble bursting drives home the importance of global governments investing in clean energy right now – as those with the least reliance on the fossil fuel industry at the time when the bubble bursts will be least impacted.

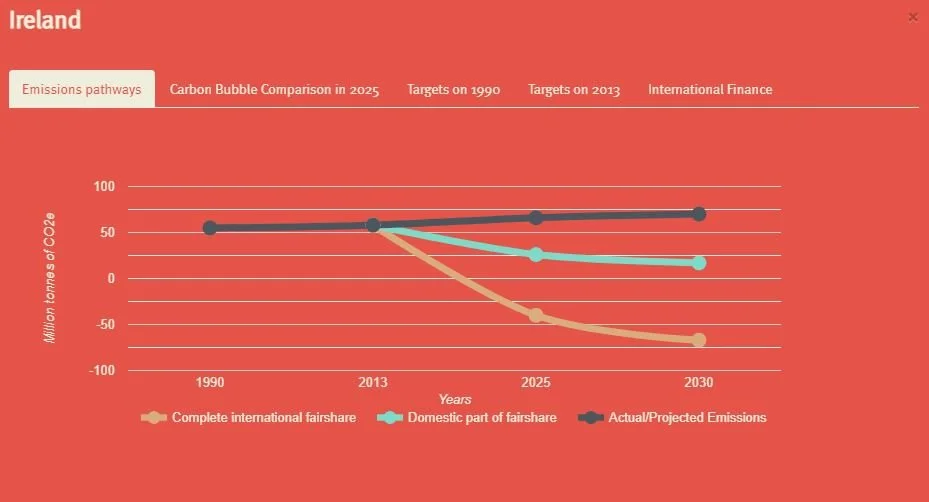

We urgently need a just climate transition, where wealthier nations responsible for higher emissions step up and help smaller nations who are most vulnerable in the face of the Climate Crisis, and who have historically accounted for the least emissions. Credit: Climate Fair Share

It is already cheaper to build and maintain renewable energy, with minimal ecological and public health side effects compared to those resulting from fossil fuel use.

It is only a lack of political will that is holding us back from a cleaner, more sustainable society that is less beholden to the volatility of the fossil fuel market.

It is essential that the Irish Government recognises this and starts to invest in renewable technologies and bottom-up incentives to help those in our society who have the least means to make the changes that are needed.

The current top-down system simply does not work.

Ireland has already missed its 2020 target of a 20% reduction in greenhouse gases, and is on course to miss its targets for 2030. Every year that meaningful action is delayed, the Irish Government worsening the Climate Crisis and leaving more of its citizens exposed to a volatile and unaffordable future.

The carbon bubble will burst. We must be ready.

Further Reading

If you are interested in learning more about the carbon bubble – a vast topic where climate science and economics collide – we’d recommend reading the following academic papers and reports on the subject, which informed this article:

Divest from the carbon bubble? Reviewing the implications and limitations of fossil fuel divestment for institutional investors – University of British Columbia (2015)

Being stranded on the carbon bubble? Climate policy risk and the pricing of bank loans – Centre for Economic Policy Research (2018)

Divestment may burst the carbon bubble if investors’ beliefs tip to anticipating strong future climate policy – Cornell University (2019)

Why market actors fuel the carbon bubble. The agency, governance, and incentive problems that distort corporate climate risk management – Cornell University (2019)

Carbon bubble toil and trouble – Nature (2014)

Reframing incentives for climate policy action - Nature Energy (2021)

What To Read Next

Capitalism vs Climate Crisis: Why It’s Time For Capitalism To Die Before We Do

The perpetual pursuit of consumption, growth and profits is a core tenet of capitalism - and one that is entirely at odds with solving the Climate Crisis

Response To IPCC Report Puts Climate Justice Into Harsh Perspective

Ireland must learn from the wrongs of Direct Provision when implementing a just transition to cater for those displaced by the Climate Crisis